reverse tax calculator ontario

This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and. It is easy to calculate GST inclusive and exclusive prices.

Realy Immobilienmarkt Immobilien Immobilienmakler

Age Amount Tax Credit 65 years of.

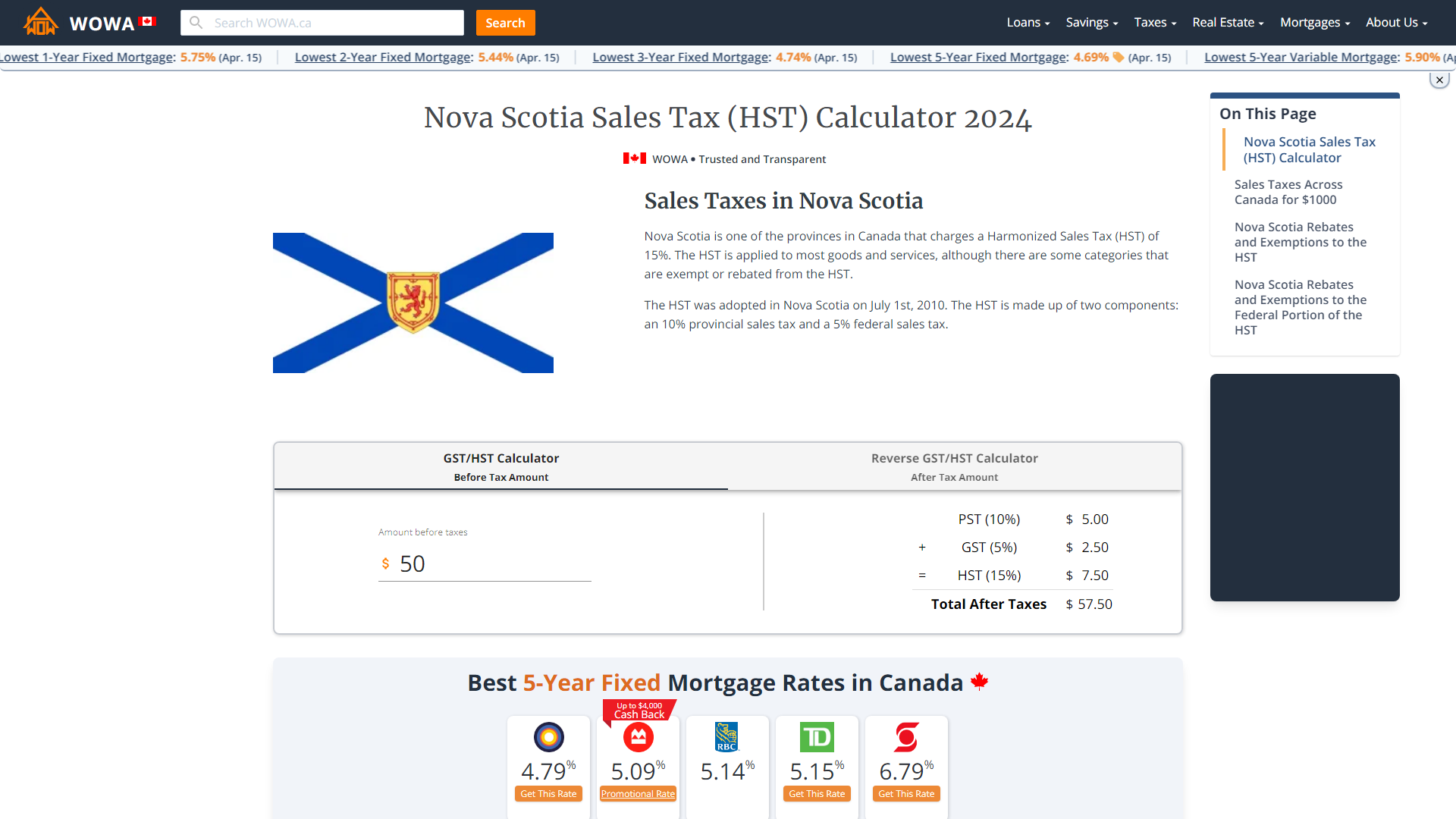

. Total After Taxes 5650. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in.

It is very easy to use it. Following is the reverse sales tax formula on how to calculate reverse tax. Calculate the total income taxes of the Ontario residents for 2021.

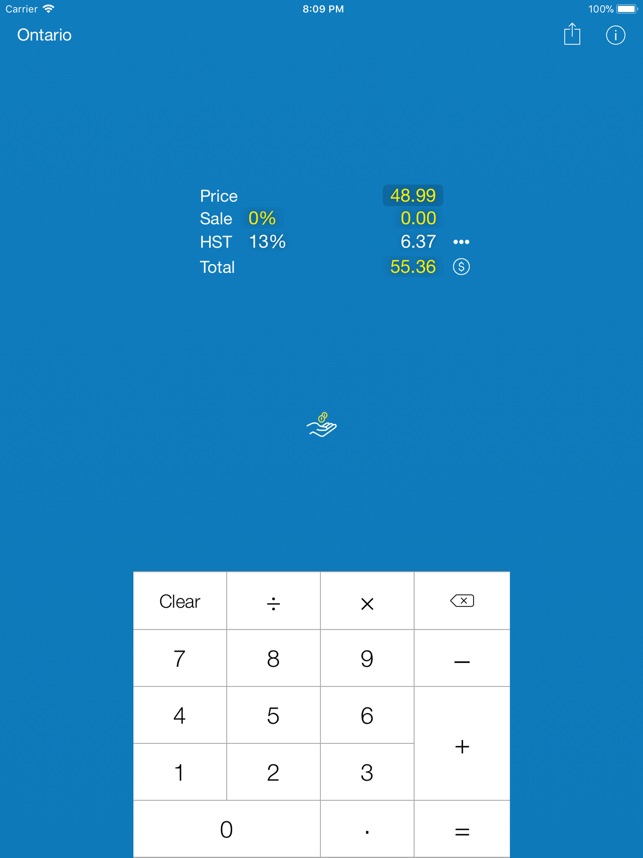

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. PST 8 400 GST 5 250 HST 13 650. Amount without sales tax x HST rate100 Amount of HST in Ontario.

Here is how the total is calculated before sales tax. That means that your net pay will be 37957 per year or 3163 per month. Enter price without HST HST value and price including HST will be calculated.

I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST. That means that your net pay will be 37957 per year or 3163 per month.

The rate you will charge depends on different factors see. Your average tax rate is. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

The following table provides the GST and HST provincial rates since July 1 2010. Provincial federal and harmonized taxes are automatically calculated for the province selected. The Ontario Income Tax Salary Calculator is updated 202223 tax year.

Your average tax rate is. Need to start with an employees net after-tax pay and work your way back to gross pay. Ontario Basic Personal Amount.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. Amount with sales tax 1 HST rate100 Amount without sales tax.

You have a total price with HST included and want to find out a price. Formula for reverse calculating HST in Ontario. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Ontario Health Preium the Canadian Pension Plan the.

Calculate GST with this simple and quick Canadian GST calculator. The HST was adopted in Ontario on. 13 for Ontario 15 for others If.

HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. Federal Basic Personal Amount. Any input field can be used.

After 1996 several provinces adopted. This free calculator is handy for determining sales taxes in Canada. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

New Brunswick Newfoundland and Labrador Nova Scotia Ontario Prince Edward Island HST Tax Rate. 13 rows The GST rate was decreased from 7 to 5 between 2006 to 2008. Type of supply learn about what.

How to Calculate Reverse Sales Tax. Enter HST value and. Ontario Personal Income Tax Brackets and Tax Rates in 2022.

YEAR 2022 2021 2020 Net Salary Per Select one. This calculator is for you. It can be used as well to reverse calculate Goods and Services.

Calculates the canada reverse sales taxes HST GST and PST. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final.

This is any monetary amount you receive as salary wages commissions. GSTHST Calculator Before Tax Amount Reverse GSTHST Calculator After Tax Amount. This is very simple HST calculator for Ontario province.

Tax reverse calculation formula. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Provinces and Territories with HST.

Want To Buy But No Down No Credit Bad Credit No Problem Classified Ad Bad Credit Bad Credit Score Loans For Bad Credit

Nova Scotia Sales Tax Hst Calculator 2022 Wowa Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

2021 2022 Income Tax Calculator Canada Wowa Ca

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Bad Credit Mortgage Financing In Ontario Bad Credit Mortgage Mortgage Help Mortgage

Newfoundland And Labrador Sales Tax Hst Calculator 2022 Wowa Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Advantages Of Solar Air Conditioning Solar Air Conditioning Visual Ly Conditioner Solar Power Grid

Reverse Hst Calculator Hstcalculator Ca

Sales Tax Canada Calculator App Price Drops

For Sale See 23 Photos 6190 Trillium Crescent Niagara Falls On 3 Bed 2 Bath 1350 Sqft House Mls 30798471 Market Niagara Falls Niagara Trillium

Pst Calculator Calculatorscanada Ca

Canada Sales Tax Gst Hst Calculator Wowa Ca

Sales Tax Canada Calculator On The App Store

Impuestos Y Tasas Que Debes Pagar Al Construir Una Casa O Comprarla Inmobiliaria Impuestos Fiscalidad Comprarcasa C Home Buying Home Loans Home Mortgage