new mexico gross receipts tax return

Property Tax Division. BEnter the total amount of gross re- ceipts tax from all Schedule A pages.

Gross Receipts Location Code And Tax Rate Map Governments

In-State Veteran Preference Certification.

. File Oil. Total Gross Receipts Tax. Enter the total amount of gross receipts excluding tax here.

In-State Veteran Preference Certification. File Gross Receipts Tax. Compensating tax is an excise tax imposed on persons using property or services in New Mexico also called use tax or buyer pays Compensating tax is reported on.

NM Business Taxes. Supreme Court decision in South Dakota v. Two types of sales must be reported on the governmental gross receipts tax return but are deductible from taxable receipts and are not subject to the tax.

Imposition and rate of tax. The changes to the GRT came primarily in response to the US. Tangible personal property including electricity and manufactured.

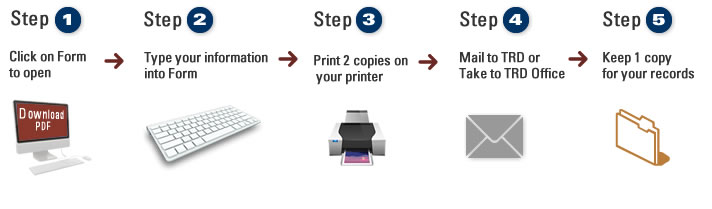

Taxation and Revenue New Mexico. As for payment E-pay is the quick and green way to. Fill Print Go.

Corporate Income Franchise Tax. The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent. The tax imposed by.

Property includes real property. Sell property in New Mexico. They offer faster service than transactions via mail or in person.

Electronic transactions are safe and secure. NM Business Taxes. File Oil.

On April 4 2019 New Mexico Gov. NM Business Taxes. If Schedule A pages are attached enter total of columns D and I.

Taxation and Revenue New Mexico. In-State Veteran Preference Certification. The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes.

Gross Receipts Location Code and Tax Rate Map. Corporate Income Franchise Tax. In general the gross receipts tax rate is origin-based determined by the business location of the seller or lessor not the location of the buyer or lessee.

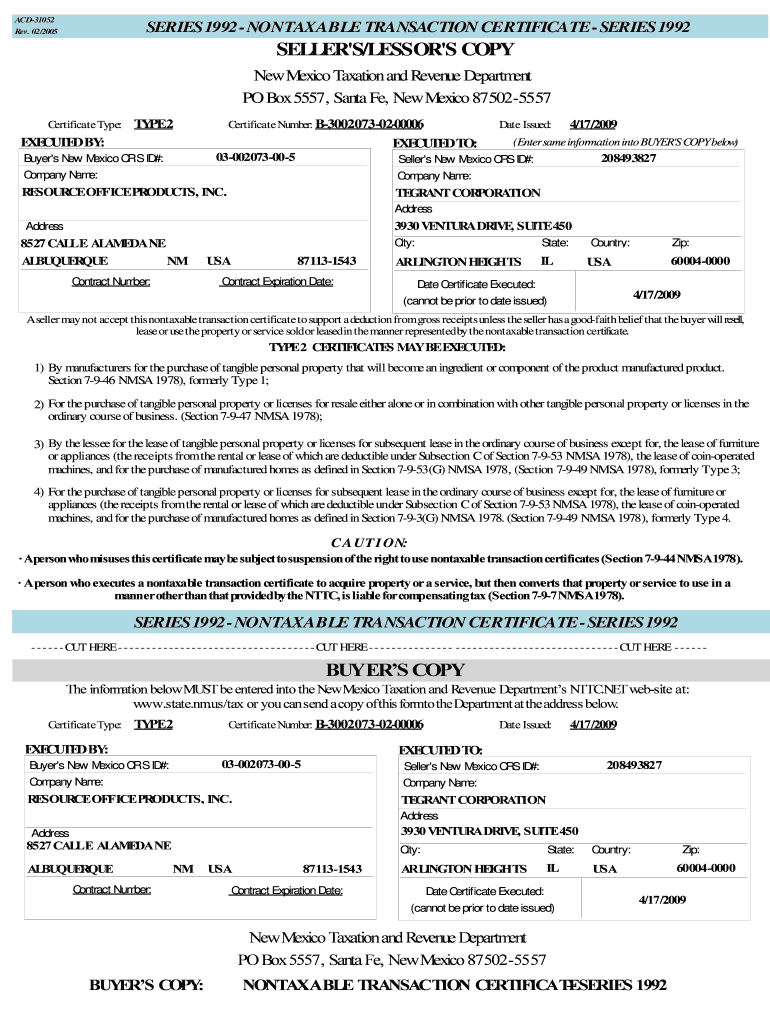

Sales to New Mexico organizations who provide an appropriate non-taxable transaction certificate NTTC are the first category. In-State Veteran Preference Certification. Request Non-Taxable Transaction Certificates NTTCs.

Corporate Income Franchise Tax. Filing online is fast efficient easy and user friendly. Depending on local municipalities the total tax rate can be as high as 90625.

Sell property in New Mexico. Register a New Business. The tax is imposed on the gross receipts of persons who.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the. Gross Receipts Tax Compensating Tax and Governmental Gross Receipts Tax IMPOSITION AND DENOMINATION 7-9-4. Gross Receipts Location Code and Tax Rate Map.

Property includes real property tangible personal property including electricity and manufactured homes licenses other than. If you are engaged in business in New Mexico you must file a New Mexico tax return and pay gross receipts tax for the privilege of doing business in New Mexico. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

New Mexico has a gross receipts tax that is imposed on persons engaged in business in New Mexico. New Mexico does not have a sales tax like other states we have a Gross Receipts Tax which means businesses pay a tax on their total receipts minus any non-taxable deductions. Your department should accept NTTCs from institutional purchasers.

The tax is imposed on the gross receipts of persons who. The New Mexico NM state sales tax rate is currently 5125. GIS Data Disclaimer applies.

NM Business Taxes. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things. Gross Receipts Location Code and Tax Rate Map.

In New Mexico it is the seller of the goods or services who is responsible for paying the tax due on the transaction. Gross Receipts Location Code and Tax Rate Map. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more.

Anything over 5125 percent represents local option rates imposed by counties and municipalities. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. File Gross Receipts Tax.

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes. For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is imposed on any person engaging in business in New Mexico. Denomination as gross receipts tax.

The gross receipts tax is a tax on persons engaged in business in New Mexico for the privilege of doing business in New Mexico. Corporate Income Franchise Tax. Gross Receipts Location Code and Tax Rate Map.

We urge you to give it a try. Taxation and Revenue New Mexico. AEnter the total amount of gross receipts tax due here.

Online Services Taxation And Revenue New Mexico

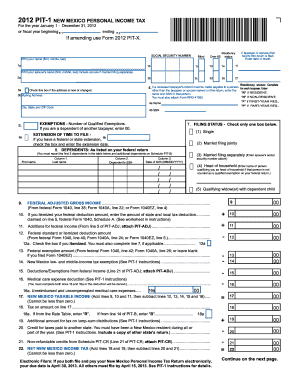

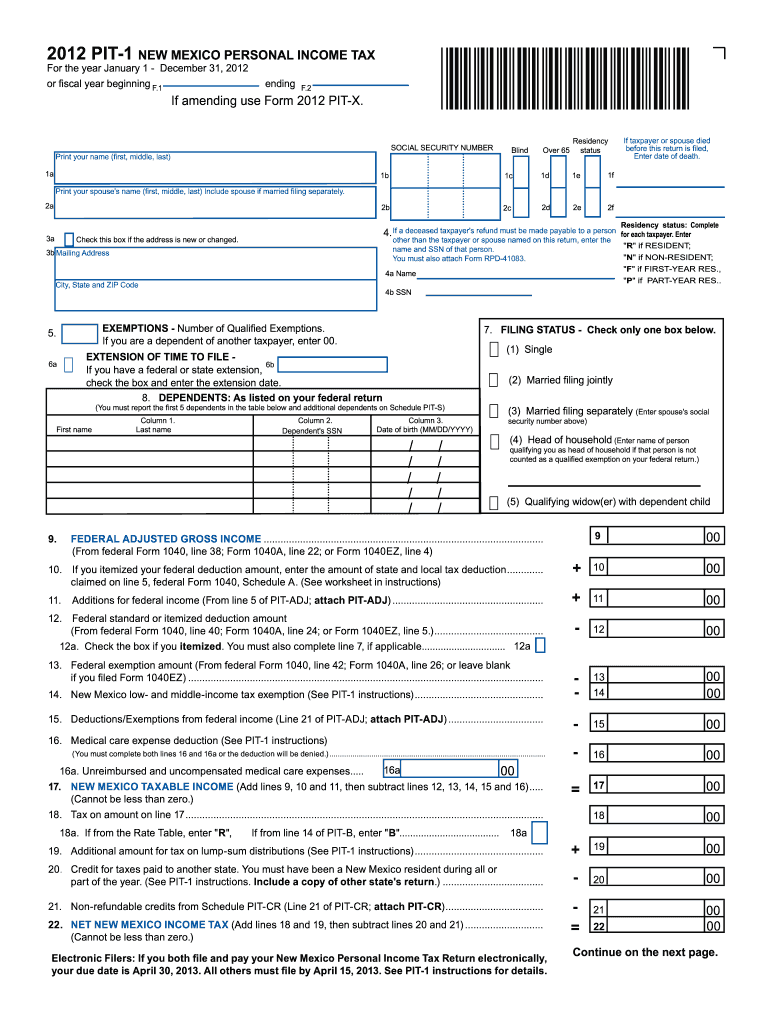

New Mexico Pit 1 Form 2020 Fill Online Printable Fillable Blank Pdffiller

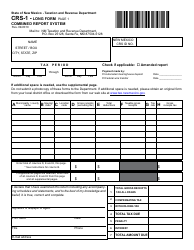

Taxhow New Mexico Tax Forms 2019

City Income Tax Return For Individuals Spreadsheet Income Tax Return Tax Return Income Tax

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

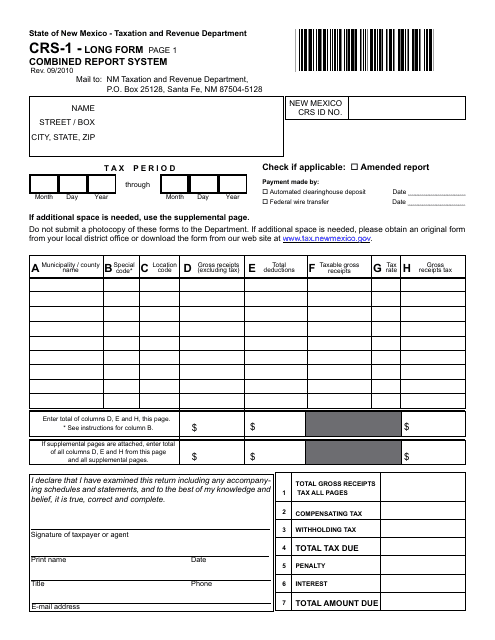

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

Global Multiservices Contact Us Today To Discuss Your Ifta Filing Assistance Options Tax Return Truck Stamps Global

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

New Mexico Sales Tax Small Business Guide Truic

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal

A Guide To New Mexico S Tax System New Mexico Voices For Children

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

Fill Print Go Taxation And Revenue New Mexico

New Mexico Pit 1 Form 2020 Fill Online Printable Fillable Blank Pdffiller